Lumina Technologies

Lumina Technologies Lumina Technologies

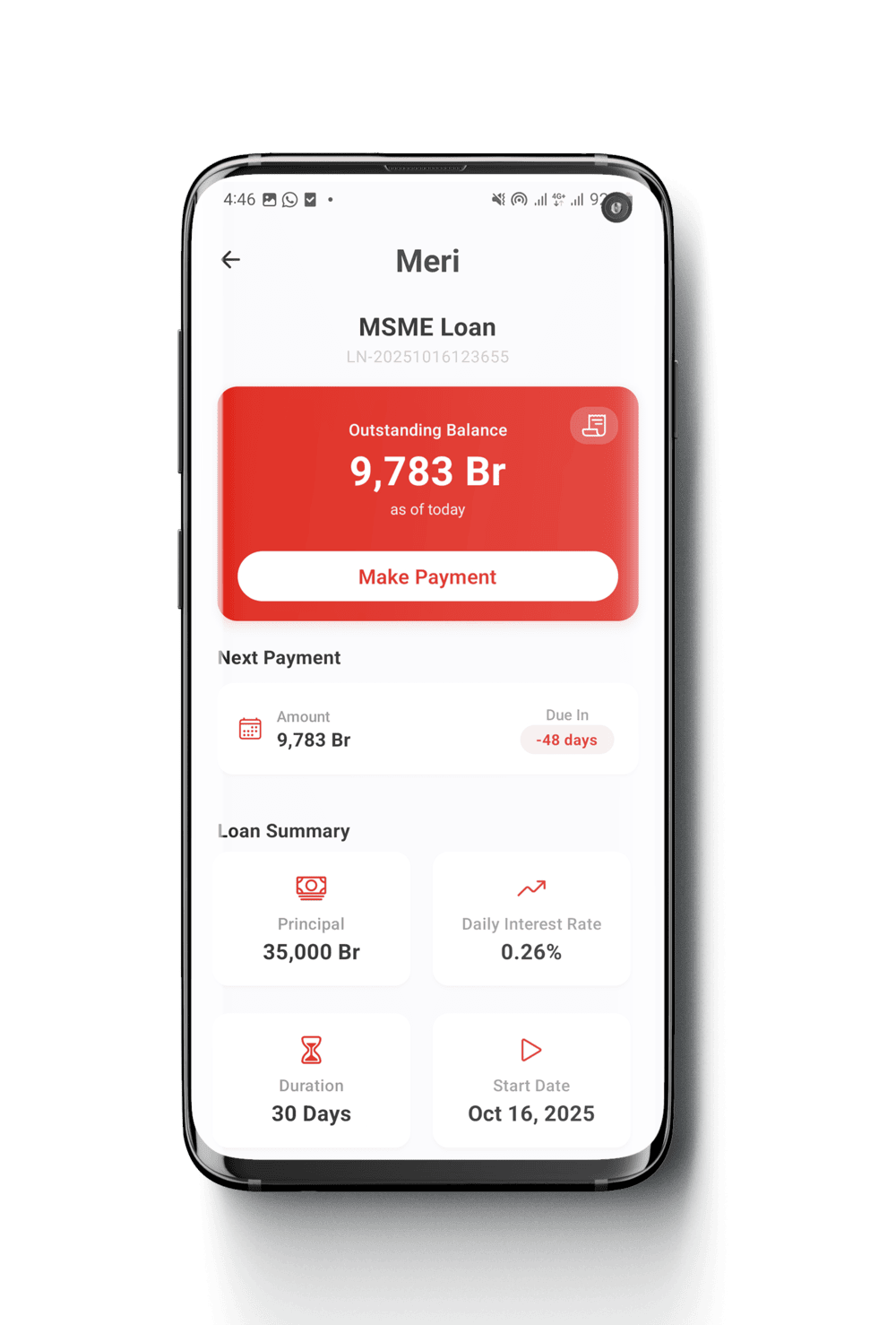

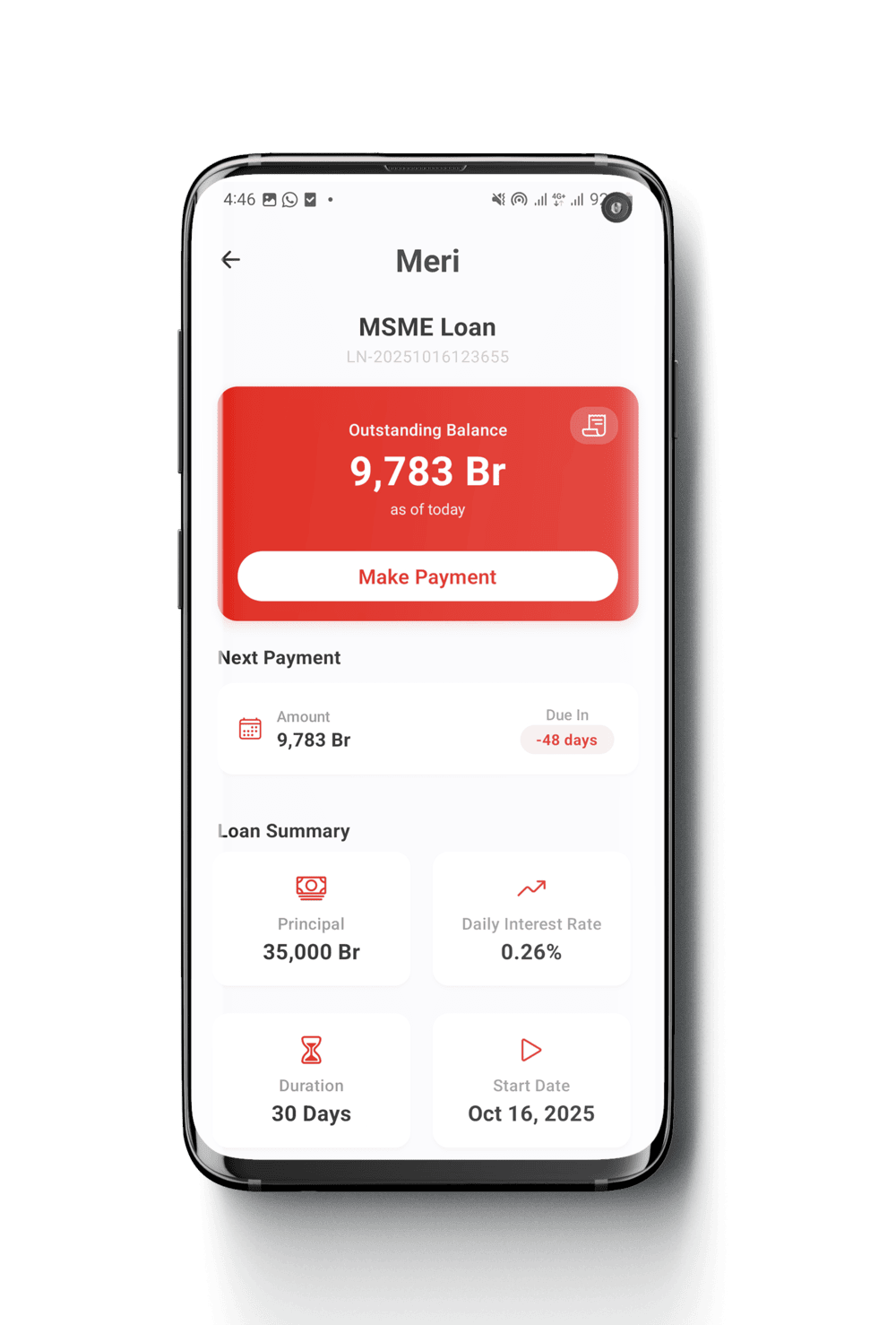

Lumina TechnologiesMeri, meaning “Guide” in Amharic, is an end-to-end digital lending platform that helps banks, MFIs, and fintechs design, launch, and scale responsible credit products with speed, intelligence, and confidence across digital and assisted channels.

Seamless lending journey from onboarding to disbursement, designed for mobile-first users

Customers apply for loans through mobile, web, USSD, or assisted channels with minimal paperwork.

Real-time decisioning using alternative data, transaction history, and configurable credit rules.

Supports personal loans, MSME loans, salary-backed loans, and supply chain financing.

Automated disbursement to bank accounts or mobile wallets once loans are approved.

Repayments via mobile money, bank transfers, payroll deduction, or agent-assisted payments.

Customers can track loan status, balances, and receive SMS or app notifications for repayments.

Customers apply for loans through mobile, web, USSD, or assisted channels with minimal paperwork.

Real-time decisioning using alternative data, transaction history, and configurable credit rules.

Supports personal loans, MSME loans, salary-backed loans, and supply chain financing.

Automated disbursement to bank accounts or mobile wallets once loans are approved.

Repayments via mobile money, bank transfers, payroll deduction, or agent-assisted payments.

Customers can track loan status, balances, and receive SMS or app notifications for repayments.

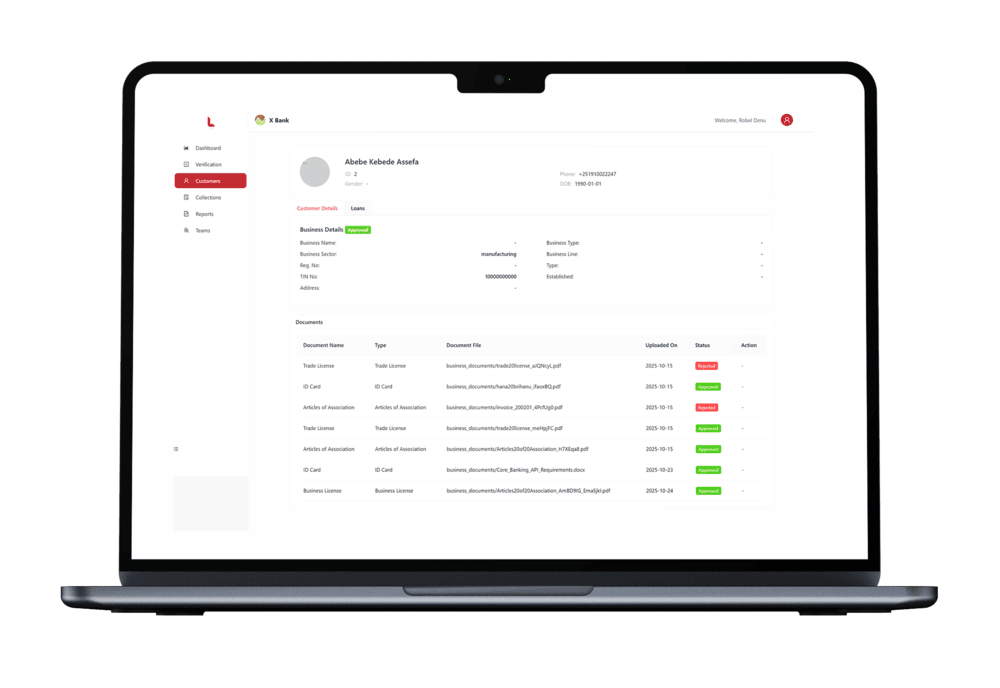

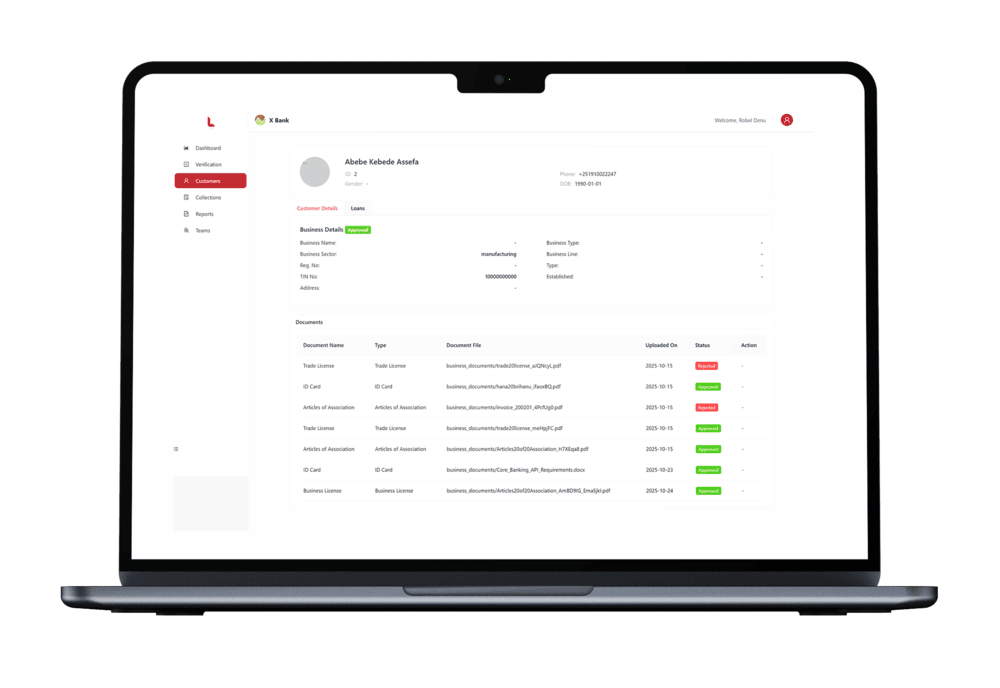

Powerful tools for lenders to manage loans, collections, and operations efficiently

Configure loan types, limits, tenures, pricing, fees, and repayment schedules without code changes.

Define credit scoring models, risk thresholds, and approval workflows centrally.

Manage borrower profiles, loan portfolios, delinquency status, and historical data.

Automated reminders, penalties, restructuring workflows, and recovery tracking.

Manage agents, employers, merchants, and embedded lending partners with role-based access.

Real-time dashboards, portfolio performance metrics, and regulatory-ready reports.

Configure loan types, limits, tenures, pricing, fees, and repayment schedules without code changes.

Define credit scoring models, risk thresholds, and approval workflows centrally.

Manage borrower profiles, loan portfolios, delinquency status, and historical data.

Automated reminders, penalties, restructuring workflows, and recovery tracking.

Manage agents, employers, merchants, and embedded lending partners with role-based access.

Real-time dashboards, portfolio performance metrics, and regulatory-ready reports.

Answers to common questions about Gasha Insurance Platform.

Request a demo or explore how Meri can power your lending operations.